What Happened Last Week?

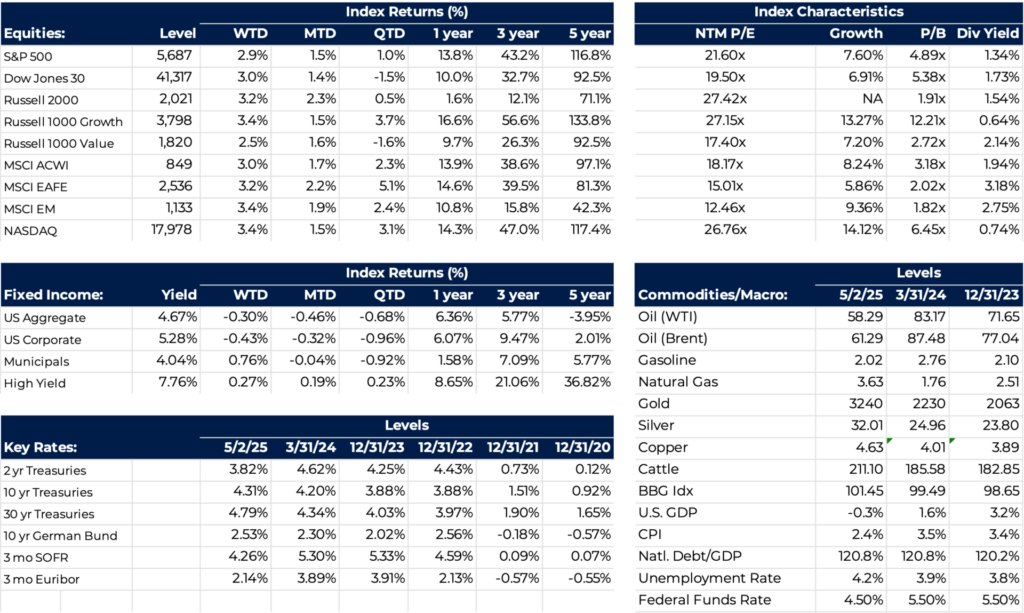

- Stocks rallied marking a second straight week of gains. The primary driver has been eased trade tensions between the U.S./China & a better than expected jobs report for the month of April.

- 70% of S&P 500 companies have reported Q1 earnings thus far, on average top line growth is 4% and bottom-line growth is 13%. Management teams in large have eliminated guidance entirely or provided bifurcated positive and negative outlooks, thereby increasing overall uncertainty.

- Interesting Fact: U.S. indices have retraced 50%+ of the decline from the recent bottom. Historically, once this halfway recovery point is reached, the market has been higher 12-months later 100% of the time.

Key Events This Week

- Important economic datapoints to be released this week include ISM Services, Mortgage Applications, and Initial Jobless Claims.

- Our focus this week will be on corporate earnings as management teams report Q1 earnings and provide commentary as it relates to underlying industry trends and developments. We’ll be paying attention to F, AMD, DIS, UBER, and more.

- Investors will hear from the Federal Reserve Chairman Jerome Powell as it relates to a policy rate change. While the consensus expectation is for rates to remain unchanged, markets will be looking for signals on the Fed’s inclination to begin easing monetary policy in the latter half of the year.

Impact on Client Portfolios

- Fixed income portfolios continue to be tilted towards capital preservation with highly rated and lower duration securities. Short term fixed income securities have less price volatility, and we expect short term rates to be more sensitive to Fed rate cuts.

- Diversification remains key as greater EPS growth is expected from the S&P 493 than Mag-7. Interest rates and growth expectations appear to be driving markets, so investors need to focus on high quality companies with clean balance sheets and a clear path to growth.

- Muted economic growth, elevated valuations and interest rates are a unique combination for markets. Fixed income may be a less effective offset to equity performance going forward. Investors should look beyond fixed income to hedge the volatility of equity returns.

Marketing Disclosure: This material is being provided for informational or educational purposes only and does not consider the investment objectives or financial situation of any client or prospective client. The information is not intended as investment advice, and is not a recommendation to buy, sell, or invest in any particular investment or market segment. Those seeking information regarding their particular investment needs should contact a financial professional. 49 Financial, our employees, or our clients, may or may not be invested in any individual securities or market segments discussed in this material. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions. All investments involve risk, including loss of principal. Past performance is not a guarantee of future results.

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.