What Happened Last Week?

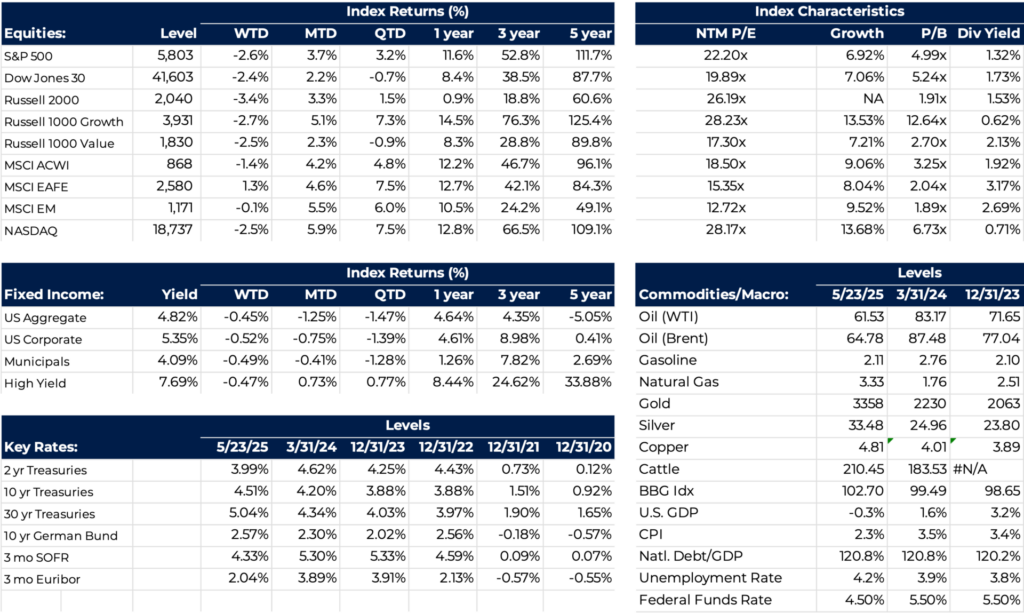

- U.S. equities fell last week as the recovery began to lose some momentum and President Trump made new tariff threats towards the European Union. However, a temporary extension was granted over the weekend to allow more time for negotiating a viable trade agreement.

- Policy Insight: Neel Kashkari has signaled that the Federal Reserve is in no rush to begin easing monetary policy. With limited clarity around growth and inflation trends, the Fed is adopting a cautious, wait-and-see stance amid rising economic uncertainty.

- Interesting Fact: The S&P 500 has now recovered 85% of its decline from peak to trough. Historically, once the market has retraced this much of a bear market, it has never gone on to revisit the prior lows. This technical signal suggests the emergence of a new leg in the ongoing bull market.

Key Events This Week

- Important economic datapoints to be released this week include Core PCE, Initial Jobless Claims, and Mortgage Applications.

- OPEC+ is scheduled to meet this week to finalize crude oil output targets. With oil prices hovering near multi-year lows, we anticipate heightened volatility in the commodity markets.

- Nvidia is set to report earnings this week, serving as a key bellwether for the broader A.I. theme. The results will offer critical insight into global enterprise demand and capital expenditure trends related to artificial intelligence.

Impact on Client Portfolios

- Fixed income portfolios continue to be tilted towards capital preservation with highly rated and lower duration securities. Short term fixed income securities have less price volatility, and we expect short term rates to be more sensitive to Fed rate cuts.

- Diversification remains key as greater EPS growth is expected from the S&P 493 than Mag-7. Interest rates and growth expectations appear to be driving markets, so investors need to focus on high quality companies with clean balance sheets and durable businesses.

- Muted economic growth, elevated valuations and interest rates are a unique combination for markets. Fixed income may be a less effective offset to equity performance going forward. Investors should look beyond fixed income to hedge the volatility of equity returns.

Marketing Disclosure: This material is being provided for informational or educational purposes only and does not consider the investment objectives or financial situation of any client or prospective client. The information is not intended as investment advice, and is not a recommendation to buy, sell, or invest in any particular investment or market segment. Those seeking information regarding their particular investment needs should contact a financial professional. 49 Financial, our employees, or our clients, may or may not be invested in any individual securities or market segments discussed in this material. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions. All investments involve risk, including loss of principal. Past performance is not a guarantee of future results.

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.