What Happened Last Week?

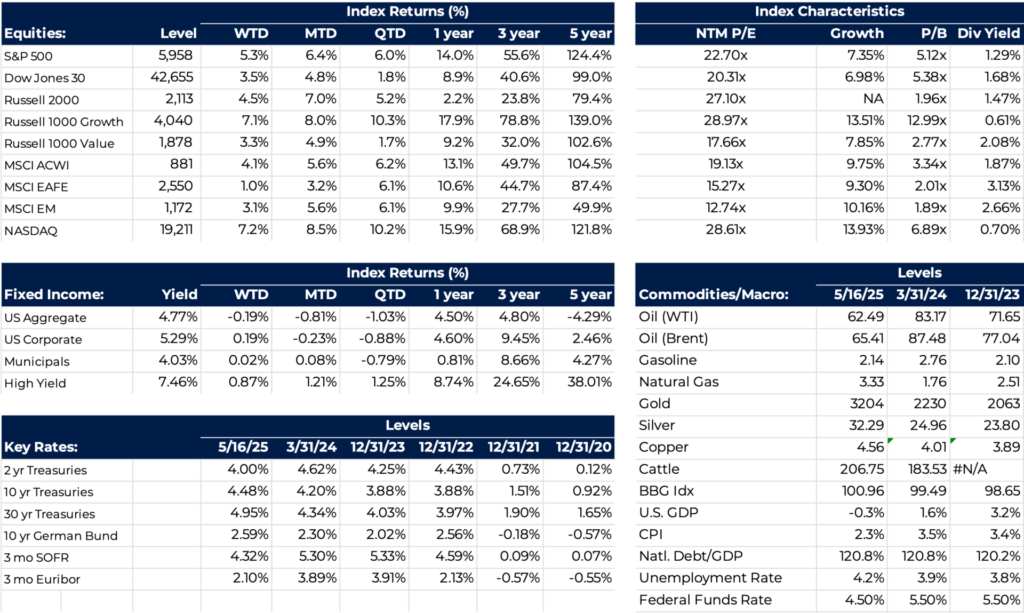

- Global equities surged last week following a de-escalation in U.S.-China trade tensions, as both nations signaled intentions to pursue a mutually beneficial agreement. As a result, recession concerns have eased.

- Moody’s downgraded the U.S. credit rating from Aaa to Aa1, the final rating agency to remove the US AAA rating. Long dated treasury yields have remained elevated through the equity market recovery, raising the question if the recovery is sustainable.

- CPI came in at 2.3% YoY marking the lowest reading in 4 years, an encouraging development for consumers and the Federal Reserve.

- Interesting Fact: Over the past six weeks, the VIX has dropped by 62%—marking the steepest decline ever recorded for that timeframe.

Key Events This Week

- Important economic datapoints to be released this week include Existing Home Sales, Jobless Claims, and Mortgage Applications.

- President Trump will be speaking with Putin and Zelensky this week as it relates to a ceasefire and eventual resolution to the Russia/Ukraine war. Investors will be keyed in on any positive developments that may come of the meeting.

- As a result of the credit downgrade all eyes will be on yields, expect equities to come under pressure in the event treasuries sell-off materially this week.

Impact on Client Portfolios

- Fixed income portfolios continue to be tilted towards capital preservation with highly rated and lower duration securities. Short term fixed income securities have less price volatility, and we expect short term rates to be more sensitive to Fed rate cuts.

- Diversification remains key as greater EPS growth is expected from the S&P 493 than Mag-7. Interest rates and growth expectations appear to be driving markets, so investors need to focus on high quality companies with clean balance sheets and a clear path to growth.

- Muted economic growth, elevated valuations and interest rates are a unique combination for markets. Fixed income may be a less effective offset to equity performance going forward. Investors should look beyond fixed income to hedge the volatility of equity returns.

Marketing Disclosure: This material is being provided for informational or educational purposes only and does not consider the investment objectives or financial situation of any client or prospective client. The information is not intended as investment advice, and is not a recommendation to buy, sell, or invest in any particular investment or market segment. Those seeking information regarding their particular investment needs should contact a financial professional. 49 Financial, our employees, or our clients, may or may not be invested in any individual securities or market segments discussed in this material. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions. All investments involve risk, including loss of principal. Past performance is not a guarantee of future results.

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.