What Happened Last Week?

- Stocks ended the week cautiously as investors await further details regarding US/China trade negotiations that are expected to occur through out the weekend. An easing of the tariff war and constructive trade developments could serve as positive catalysts for equities.

- 90% of S&P 500 companies have reported earnings for the quarter, on avg top line growth is 4% and bottom-line growth is 12%. The wildcard remains what happens through the remainder of 2025. We will hear from a host of retailers to cap off earnings season.

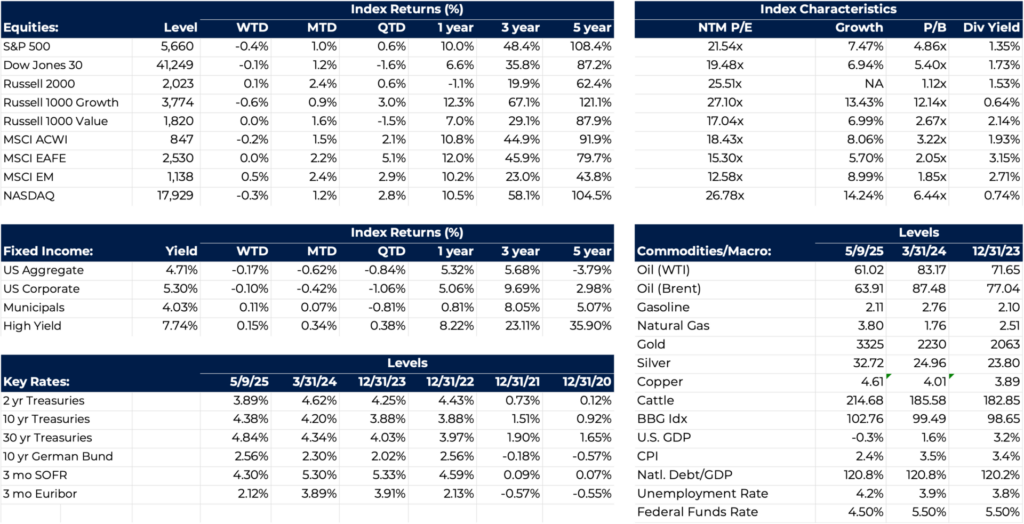

- At last week’s FOMC meeting, the Federal Reserve opted to keep interest rates unchanged. Notably, policymakers emphasized a data-dependent approach, signaling that future adjustments will hinge on clear signs of economic stress. Investors anticipate policy easing once tangible economic strain emerges.

Key Events This Week

- Important economic datapoints to be released this week include CPI, Mortgage Applications, and Retail Sales.

- Oil prices fell below $60 per barrel following an OPEC+ production increase and diminished global demand outlook. This development is likely to significantly impact inflation expectations and consumer sentiment. The upcoming CPI release will be a key indicator of whether inflation is on a sustainable path back to the central bank’s 2% target.

- Expect markets to be reactive in nature to the broader headlines this week, U.S.-China trade negotiations serving as a key short-term driver for global equities.

Impact on Client Portfolios

- Fixed income portfolios continue to be tilted towards capital preservation with highly rated and lower duration securities. Short term fixed income securities have less price volatility, and we expect short term rates to be more sensitive to Fed rate cuts.

- Diversification remains key as EPS growth continues to broaden past the largest US companies. Interest rates and growth expectations appear to be driving markets, so investors need to focus on high quality companies with clean balance sheets and a clear path to growth.

- Muted economic growth, elevated valuations and interest rates are a unique combination for markets. Fixed income may be a less effective offset to equity performance going forward. Investors should look beyond bonds to hedge the volatility of equity returns.

Marketing Disclosure: This material is being provided for informational or educational purposes only and does not consider the investment objectives or financial situation of any client or prospective client. The information is not intended as investment advice, and is not a recommendation to buy, sell, or invest in any particular investment or market segment. Those seeking information regarding their particular investment needs should contact a financial professional. 49 Financial, our employees, or our clients, may or may not be invested in any individual securities or market segments discussed in this material. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions. All investments involve risk, including loss of principal. Past performance is not a guarantee of future results.

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.