What Happened Last Week?

- Equities advanced over the week amid renewed scrutiny of the Trump-era tariffs. Greater clarity is anticipated as the Supreme Court reviews whether the President has the authority to impose broad-based tariffs.

- Nvidia capped off a strong earnings season for major tech firms offering support for stock prices as markets factor in continued optimism for the remainder of the year.

- Late last week President Trump announced a 50% tariff on imported steel & aluminum and the E.U. announced intentions of imposing counter-measures.

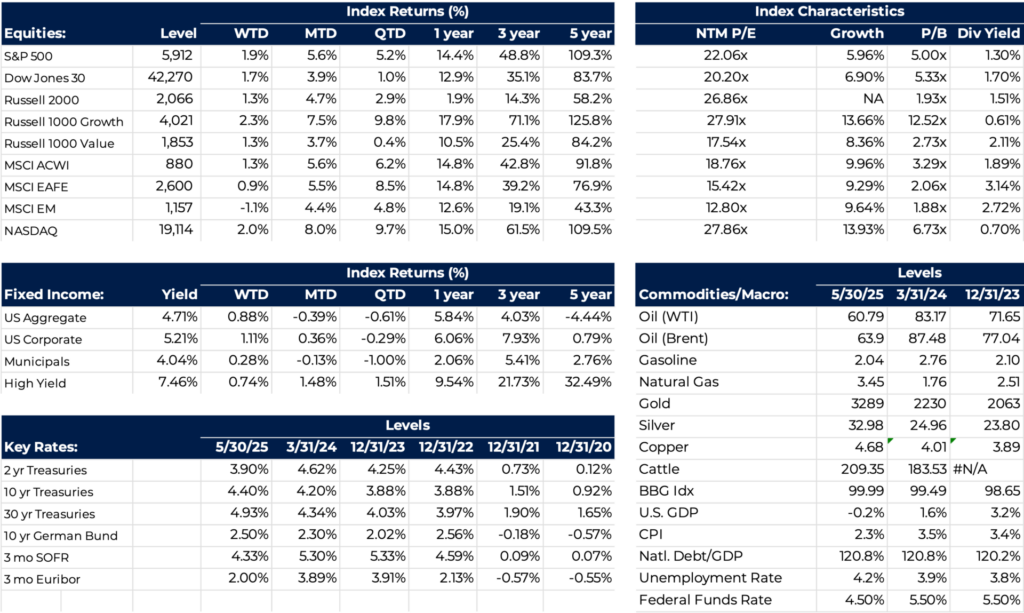

- Interesting Fact: The S&P 500 delivered its strongest May performance since 1990, while the Nasdaq saw its best May gains since 1997.

Key Events This Week

- Important economic datapoints to be released this week include JOLTS, Nonfarm Payrolls, and Mortgage Applications.

- Presidents Trump and Xi are scheduled to engage in trade discussions this week—a pivotal moment that will likely determine whether a meaningful trade agreement is achieved or if the tariff dispute intensifies.

- The non-farm payroll report is due this week, and investors will be closely watching for insights into labor market trends.

Impact on Client Portfolios

- Fixed income portfolios continue to be tilted towards capital preservation with highly rated and lower duration securities. Short term fixed income securities have less price volatility, and we expect short term rates to be more sensitive to Fed rate cuts.

- Diversification remains key as greater EPS growth is expected from the S&P 493 than Mag-7. Interest rates and growth expectations appear to be driving markets, so investors need to focus on high quality companies with clean balance sheets and a clear path to growth.

- Muted economic growth, elevated valuations and interest rates are a unique combination for markets. Fixed income may be a less effective offset to equity performance going forward. Investors should look beyond fixed income to hedge the volatility of equity returns.

Marketing Disclosure: This material is being provided for informational or educational purposes only and does not consider the investment objectives or financial situation of any client or prospective client. The information is not intended as investment advice, and is not a recommendation to buy, sell, or invest in any particular investment or market segment. Those seeking information regarding their particular investment needs should contact a financial professional. 49 Financial, our employees, or our clients, may or may not be invested in any individual securities or market segments discussed in this material. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions. All investments involve risk, including loss of principal. Past performance is not a guarantee of future results.

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.