Q1 2025 (Net of Management Fees)

49 Financial Long-Term Aggressive: +1.44%

Long-Term Aggressive Benchmark*: -0.56%

Since Inception | 5/1/24 - 4/21/25 (Net of Management Fees)

49 Financial Long-Term Aggressive: +5.47%

49 Financial Long-Term Benchmark*: +4.66%

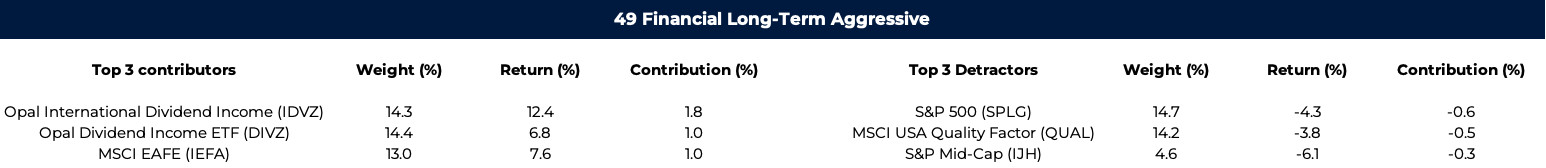

Portfolio performance was primarily driven by both domestic and international Opal-led funds, which maintained a strong tilt toward dividend-paying companies. These strategies focused on firms with consistent revenue generation, strong balance sheets, and appealing dividend payout ratios. Furthermore, favorable shifts in international market conditions —including greater liquidity, falling interest rates, and improving economic fundamentals —contributed to a resurgence in developed market equities.

The primary detractors in the portfolio came from domestic U.S. indices such as the S&P 500, S&P 400, and large-cap growth adjacent stocks. A slowdown in both revenue and earnings growth coupled with historically elevated valuations led to a sell-off in these crowded trades.

*49 Financial Long-Term Benchmark: 81% ACWI | 9% S&P GSCI | 8% Bloomberg U.S. Government Credit 1-3 year | 2% Cash

Q1 2025 (Net of Management Fees)

49 Financial Long-Term Conservative: +2.93%

Long-Term Conservative Benchmark*: -0.56%

Since Inception | 5/1/24 - 4/21/25 (Net of Management Fees)

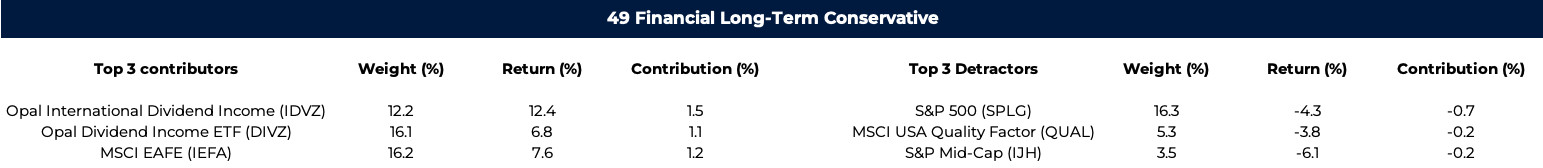

Portfolio performance was primarily driven by both domestic and international Opal-led funds, which maintained a strong tilt toward dividend-paying companies. These strategies focused on firms with consistent revenue generation, strong balance sheets, and appealing dividend payout ratios. Furthermore, favorable shifts in international market conditions —including greater liquidity, falling interest rates, and improving economic fundamentals —contributed to a resurgence in developed market equities.

The primary detractors in the portfolio came from domestic U.S. indices such as the S&P 500, S&P 400, and large-cap growth adjacent stocks. A slowdown in both revenue and earnings growth coupled with historically elevated valuations led to a sell-off in these crowded trades.

*49 Financial Long-Term Benchmark: 81% ACWI | 9% S&P GSCI | 8% Bloomberg U.S. Government Credit 1-3 year | 2% Cash

Q1 2025 (Net of Management Fees)

49 Financial Intermediate Term: +2.78%

Intermediate-Term Benchmark*: +0.16%

Since Inception | 5/1/24 - 4/21/25 (Net of Management Fees)

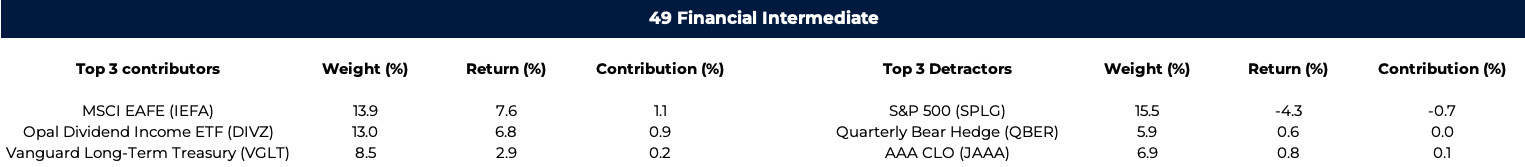

Key contributors to portfolio performance included the Opal Dividend Income strategy, a fund focused on developed markets outside the U.S., and a long-duration treasury bond fund. These strategies targeted companies with dependable revenue streams, robust balance sheets, and compelling dividend payout ratios. Furthermore, evolving conditions in international markets—marked by improved liquidity, falling interest rates, and strengthening fundamentals—bolstered a recovery in developed market equities. Lastly, amid heightened growth concerns, long-term U.S. Treasury bonds—particularly the 10- and 20-year maturities—appreciated in value, further enhancing the portfolio’s quarterly performance.

The primary detractors of performance were the S&P 500, Quarterly Bear Hedge, and JAAA CLO ETF.

*49 Financial Intermediate-Term Benchmark: 54% ACWI | 6% S&P GSCI | 38% Bloomberg U.S. Government Credit 1-3 year | 2% Cash

Q1 2025 (Net of Management Fees)

49 Financial Short Term: +1.55%

Short Term Benchmark*: +1.10%

Since Inception | 5/1/24 - 4/21/25 (Net of Management Fees)

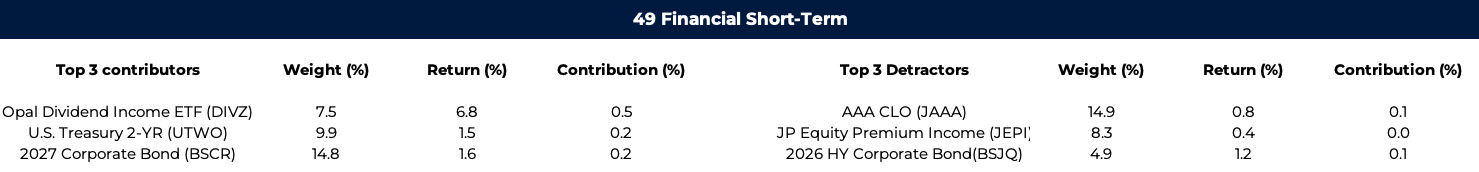

The primary contributors to portfolio performance were the Opal Dividend Income fund, 2-Year Treasury Note, and the 2027 corporate bond ETF.

The primary detractors of performance were JAAA CLO ETF, JP Morgan Hedged Equity product, and the 2026 high-yield corporate bond fund.

*49 Financial Short-Term Benchmark: 20% ACWI | 4% S&P GSCI | 74% Bloomberg U.S. Government Credit 1-3 year | 2% Cash

49 Wealth Management, LLC d/b/a 49 Financial, is an SEC registered investment adviser. Registration with the SEC does not imply a certain level of skill or expertise. All investment advisory activities are performed through 49 Financial. All commissionable product sales are performed through and under the supervision of Oakwood Capital Securities (“Oakwood Capital”). 49 Financial and Oakwood Capital are not affiliated entities. Please visit https://adviserinfo.sec.gov/firm/summary/319484 For additional information regarding 49 Financials’ services, fees, conflicts of interest, and other important information.

The information presented herein is provided for general informational purposes only and does not constitute investment advice, a recommendation to purchase or sell any security, or a solicitation of any kind. The views expressed are those of the CIO as of the date shown and may change in response to market conditions.

Past performance is not indicative of future results. The investment results and returns shown in this presentation are for informational purposes only and do not guarantee future performance or investment success. Performance data presented may reflect gross returns (before fees and expenses) or net returns (after fees and expenses). Please refer to the specific details provided for clarification on which applies.