The Historical Appeal of Passive Investing

For over a decade, global markets operated in a uniquely accommodative environment. Central banks, led by the Federal Reserve, kept interest rates low, while governments deployed massive fiscal stimulus programs. This combination of low borrowing costs and abundant liquidity fueled a strong, sustained bull market.

In this climate, passive investing flourished. Low-cost index funds tracking broad market indices like the S&P 500 and MSCI ACWI became the preferred choice for many. The prevailing mindset—“a rising tide lifts all boats”—encouraged investors to ride the market’s momentum, avoiding the complexity of individual stock selection or sector analysis.

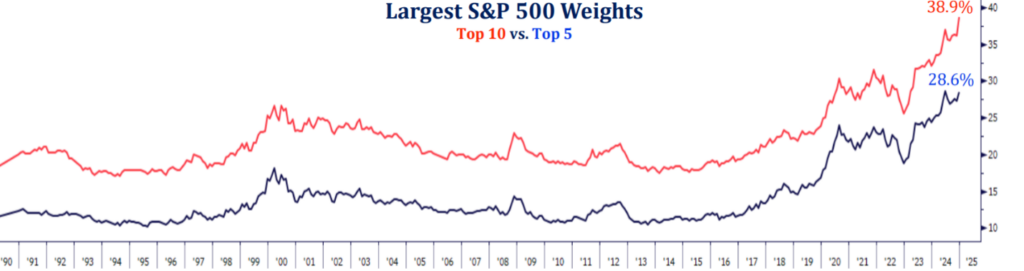

Market capitalization-weighted indices became the vehicle of choice, with the largest companies receiving outsized inflows simply by virtue of their size. This dynamic often decoupled stock prices from business fundamentals, reinforcing a momentum-driven market and exacerbating index concentration risk.

Source: Strategas Research

The Structural Shift: From Tailwinds to Headwinds

Today’s macroeconomic landscape is fundamentally different. With inflation concerns top of mind interest rates have risen to levels not seen in over a decade. Simultaneously, fiscal policy is constrained by growing concerns about sovereign debt levels.

This paradigm shift brings with it a more challenging, uncertain, and nuanced market environment. We are moving into an era where:

- Volatility is more commonplace,

- Market direction is less predictable,

- The easy gains of the past decade may not be so easily repeated.

In this environment, passive investing may no longer deliver the same risk-adjusted returns. By design, passive strategies are backward-looking, allocating capital based on market capitalization—not on merit, valuation, or forward-looking potential.

Active Portfolio Management Is More Relevant Than Ever

Active management regains strategic importance in a market where fundamentals matter again. It requires skill, insight, and discipline—attributes that are especially valuable in today’s landscape of reduced liquidity and fading policy support.

Here are three key advantages of active investing in the current market context:

1. Opportunity Capture

Active managers can lean into the best opportunities by allocating capital toward high-quality businesses, sectors, or regions with superior fundamentals and long-term potential.

2. Risk Management

With greater dispersion in returns, active strategies offer more tools to manage downside risk and respond to dynamic market conditions.

3. Tactical Flexibility

Unlike static indices, active strategies can pivot in real time to adapt to shifts in sentiment, policy, or fundamental variables.

Rather than viewing active and passive as binary choices, blending them allows for passive exposure where appropriate, while actively managing around specific risks or inefficiencies.

Time for a Thoughtful Reassessment

Passive investing will always have a place in diversified portfolios. But in this new era of elevated rates, fiscal restraint, and heightened macro uncertainty, the balance must be reconsidered.

We encourage investors to reflect on their current strategy and ask: Is it prepared for what’s ahead? Now more than ever, portfolios require intentional construction, rigorous analysis, and adaptive management.

At Opal Capital, we are committed to navigating this evolving landscape with clarity, diligence, and an unwavering focus on your long-term financial success.

Manav Shah, CFA

Portfolio Manager

All Investment Advisory Services are provided by 49 Wealth Management d/b/a 49 Financial, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Additional information about 49 Wealth Management d/b/a 49 Financial, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-123687 49 Financial does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.

The comparison of active versus passive portfolio management is intended for informational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Active management involves ongoing investment decisions and may offer the potential for outperformance but typically incurs higher fees and may underperform benchmarks. Passive management aims to replicate market indexes with lower fees but may not respond to changing market conditions. Each strategy has its own risks and benefits. Investors should carefully consider their personal financial goals, risk tolerance, and investment timeline before choosing a management approach. Past performance is not indicative of future results.